Schedules

The American University Payroll Office is dedicated to providing excellent service to all faculty, staff and student employees by posting a payroll schedule of the deadlines that must be met to ensure accurate and timely payments. We've provided a list of other important dates that are related to payroll, taxes and leave balances.

Biweekly Payroll

Monthly Payroll

Adjunct Faculty

Biweekly Payroll Schedule(May 2024 - December 2025)

All business processes and pay inputs must be submitted to payroll by close of business, at least four (4) business days before pay day.

For the biweekly payroll, this is typically the Monday before pay day, but may be earlier on weeks when a university holiday occurs.

**Due dates marked with asterisks are adjusted to accommodate weeks with holidays.

***Workday allows self-service adjustments to time entered. Adjustments will appear on the next regularly scheduled paycheck. For adjustments needed after the Close Time Entry date, please contact hrpayrollhelp@american.edu.

All schedules are subject to change.

A printable PDF is also available.

Monthly Payroll Schedule(June 2024-December 2025)

Changes are due at least four business days before payday.

*Due dates marked with asterisks are early to allow sufficient payroll processing during weeks with holidays.

Monthly Payroll Schedule | Pay Period | Changes Due End of Day | Payroll Payment Date |

|---|

| Jun 01 – Jun 30 | Jun 24 | Friday, June 28, 2024 |

| Jul 01 – Jul 31 | Jul 26 | Wednesday, July 31, 2024 |

| Aug 01 – Aug 31 | Aug 26 | Friday, August 30, 2024 |

| Sep 01 – Sep 30 | Sep 24 | Monday, September 30, 2024 |

| Oct 01 – Oct 31 | Oct 25 | Thursday, October 31, 2024 |

| Nov 01 – Nov 30 | Nov 22* | Friday, November 29, 2024 |

| Dec 01 – Dec 31 | Dec 16* | Tuesday, December 31, 2024 |

| Jan 01 – Jan 31 | Jan 27 | Friday, January 31, 2025 |

| Feb 01 – Feb 28 | Feb 24 | Friday, February 28, 2025 |

| Mar 01 – Mar 31 | Mar 25 | Monday, March 31, 2025 |

| Apr 01 – Apr 30 | Apr 24 | Wednesday, April 30, 2025 |

| May 01 – May 31 | May 23* | Friday, May 30, 2025 |

| Jun 01 – Jun 30 | Jun 24 | Monday, June 30, 2025 |

| Jul 01 – Jul 31 | Jul 25 | Thursday, July 31, 2025 |

| Aug 01 – Aug 31 | Aug 25 | Friday, August 29, 2025 |

| Sep 01 – Sep 30 | Sep 24 | Tuesday, September 30, 2025 |

| Oct 01 – Oct 31 | Oct 27 | Friday, October 31, 2025 |

| Nov 01 – Nov 30 | Nov 21* | Friday, November 28, 2025 |

| Dec 01 – Dec 31 | Dec 17* | Wednesday, December 31, 2025 |

Time Off Approvals in Workday:

Time Off requests should be submitted in advance for annual leave and for sick leave as soon as possible; requests will be charged against the balance when it occurs.

Managers should monitor their Workday inbox to regularly approve Time Off requests. |

All schedules are subject to change.

A printable PDF is also available.

Adjunct Faculty Biweekly Payroll

Adjunct faculty are paid on a variety of biweekly and monthly schedules depending on the position and the period of instruction. You can view your schedule in Workday by doing the following:

View Your Payment Details in Workday

- After logging into Workday, click on the profile icon in the upper right-hand corner of the Workday screen.

- Click on View Profile.

- Click on Compensation in the menu on the left-hand side of the screen.

- Click on Current Activity Pay tab at the top of the screen.

- Click on the View Payment Details button.

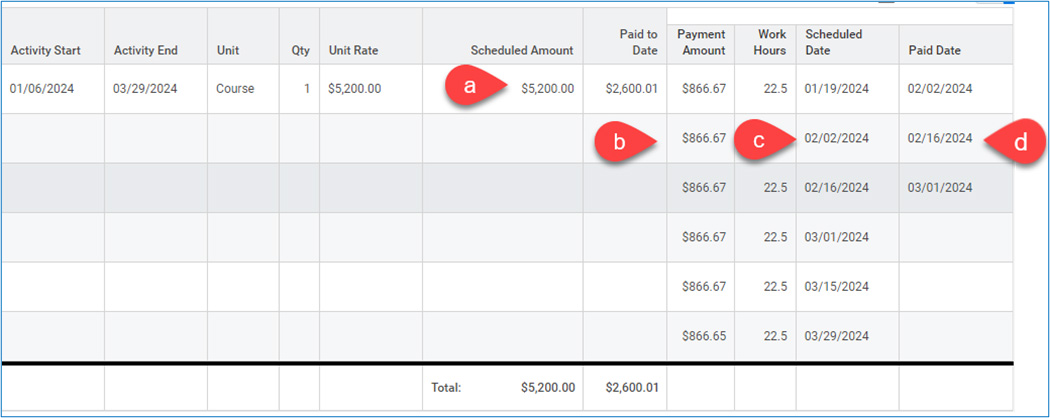

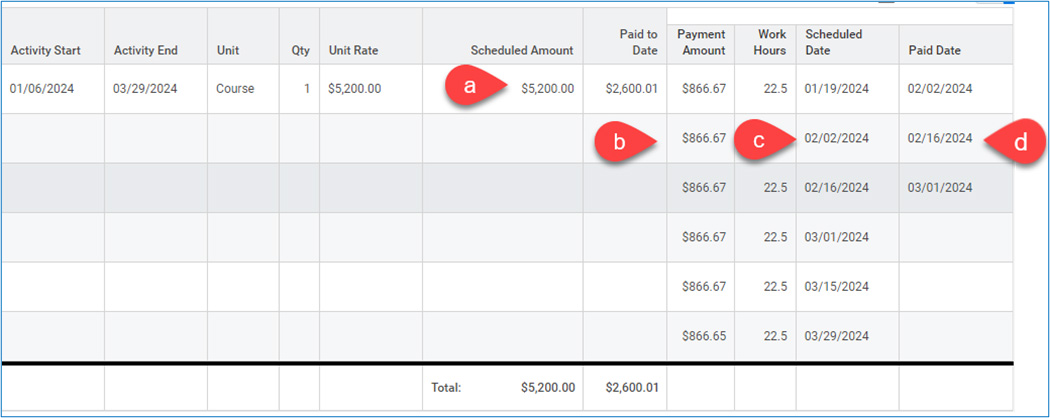

- The Period Activity Payment Details screen will display:

- the total Scheduled Amount to be paid

- the Payment Amount to be included in each paycheck

- the Scheduled Date* (which is the end of the biweekly pay period in the example below)

- the Paid Date.

* To determine the payment date for upcoming payments, the Scheduled Date on the Period Activity Payment Details screen will correspond to the last day of the pay period on the biweekly schedule tab (for most adjuncts) or the monthly schedule tab (for adjuncts who have primary postitions at AU that are on the monthly pay schedule).

From your Workday profile:

- Click on Job on the left-hand menu.

- Click on the Organizations tab at the top of the screen.

- Scroll down to the Pay Group Organization Type.

- The Monthly or Biweekly pay group will be listed in the Organization column.

Adjunct Faculty Holding Staff Positions at the University

For adjunct faculty who also hold full time positions at American University, pay groups are assigned based on the adjunct’s primary role. This means if you are a salaried employee on the monthly payroll, the pay for your adjunct position will also be paid on the same paycheck as your primary position. Similarly, employees who hold a primary role that is paid on the biweekly payroll will receive their adjunct pay on the biweekly payroll along with the wages for their primary position.

Can I receive my adjunct pay on a different schedule from my primary role?

Unlike our previous payroll system, Workday is configured to only allow employees to be in one pay group (that is, either biweekly or monthly). This is current best practice as it results in the most accurate tax withholding per Internal Revenue Service (IRS) guidelines and avoids under withholding taxes for employees, which can lead to underpayment penalties.

How can I minimize my tax liability?

If you have concerns about the taxes being withheld from your pay, you have the option to adjust your tax withholdings. Unfortunately, the university is not allowed to give tax advice. Given the complexity of tax matters and potential impact on employee finances, we highly recommend that employees consider seeking guidance from a qualified tax advisor.

Additional Resources:

- IRS Tax Withholding Estimator: https://www.irs.gov/individuals/tax-withholding-estimator

- IRS Publication 15-T: Federal Income Tax Withholding Methods

- Workday: Manage Your Tax Elections (instructions to review and update tax withholding)